BISAC NAT010000 Ecology

BISAC NAT045050 Ecosystems & Habitats / Coastal Regions & Shorelines

BISAC NAT025000 Ecosystems & Habitats / Oceans & Seas

BISAC NAT045030 Ecosystems & Habitats / Polar Regions

BISAC SCI081000 Earth Sciences / Hydrology

BISAC SCI092000 Global Warming & Climate Change

BISAC SCI020000 Life Sciences / Ecology

BISAC SCI039000 Life Sciences / Marine Biology

BISAC SOC053000 Regional Studies

BISAC TEC060000 Marine & Naval

Every aspect of human operations faces a wide range of risks, some of which can cause serious consequences. By the start of 21st century, mankind has recognized a new class of risks posed by climate change. It is obvious, that the global climate is changing, and will continue to change, in ways that affect the planning and day to day operations of businesses, government agencies and other organizations and institutions. The manifestations of climate change include but not limited to rising sea levels, increasing temperature, flooding, melting polar sea ice, adverse weather events (e.g. heatwaves, drought, and storms) and a rise in related problems (e.g. health and environmental). Assessing and managing climate risks represent one of the most challenging issues of today and for the future. The purpose of the risk modeling system discussed in this paper is to provide a framework and methodology to quantify risks caused by climate change, to facilitate estimates of the impact of climate change on various spheres of human activities and to compare eventual adaptation and risk mitigation strategies. The system integrates both physical climate system and economic models together with knowledge-based subsystem, which can help support proactive risk management. System structure and its main components are considered. Special attention is paid to climate risk assessment, management and hedging in the Arctic coastal areas.

climate change, climate and weather risks, Arctic coastal areas, risk hedging.

The climate of our planet is changing continuously impacting the nature and humanity and affecting the regular daily operations of various organizations, institutions, businesses and economic entities. There is increasing scientific and empirical evidence that the earth’s climate undergoes change, both on short-term (decades) and long-term (thousands of years) basis [1]. Some essential facts that show climate alterations are as follows. The globally-averaged air surface temperature on our planet has increased by ~0.80 C since 1880, with two-thirds of the worming occurring since the 1970s. Also the ocean is warming up notably in the top layer. The thickness of such a layer is about several hundred meters. The amount of heat accumulated in the ocean accounts about 90 percent of the total heat stored in the land, air and ocean since the mid of 1970s. Sea level has risen globally and the average rising rate continues to grow. Current sea level growth rate is about 3.2 mm per year, and rates of sea level rise are spatially and temporarily inhomogeneous. Ocean currents are changing, in particular in the North Atlantic. There are lots of scientific arguments that the intensity and frequency of different extreme natural events, including weather events such as heatwaves, tropical cyclones, cold waves (snaps), extreme rainfall and droughts are changing around the world under global warming. Altered rainfall patterns in different parts of the world, melting polar sea ice, flooding and a rise in related problems (e.g. health and environmental) serve also as indicators of global climate change.

The projected changes in climate such as a rise in sea level, changes in temperatures, the direction and the power of ocean waves, wind, precipitations, ice-cover and extreme weather events will affect the human activities in coastal areas around the globe (e.g. [2, 3]). The coastline of many countries including Russia is highly populated and has a well-developed infrastructure. Coastal and ocean activities, such as the marine transportation, port activities, offshore development of hydrocarbons, fishing, leisure activities, recreation and tourism, industrial activities which require seawater supply, are inalienable part to the economy. Coastal habitats, which are home for variety of living species, are strongly affected by climate change via sever weather events, sea level rise and rainfall patterns. The coastal zones already face a variety of problems caused by climate change. For example, coastal flooding, water pollution and erosion of shorelines influence the economic infrastructure and coastal ecosystems. The impact of continuing global warming will apparently be the cause of the deterioration of all these problems. Climate change is anticipated to be more notable in polar and subpolar regions compared to other geographical regions due to the phenomenon known as a polar amplification [1]. Since Russian Northern coast is a vast territory lays for a few thousand kilometers, assessment of the climate change impact on human activities and on the environment in these geographical areas is a very critical issue for the Russian Federation.

By the start of 21st century, mankind has recognized risk posed by climate change. This risk referred to as a climate risk is a result of climate change that can directly and/or indirectly affect natural and human systems. Climate risk assessment and management represent a very important component in developing adaptation measures to mitigate the consequences of global warming. Adaptation to climate change implies elaborating practically feasible mechanisms to manage risks arisen from climate impacts in order to protect people and strengthen the economy.

Generically risk management is a process that enables the identification of risks, followed by an estimate of their consequences and the likelihood of those consequences occurring. Risk management methods are already widely used in the development of climate change adaptation plans and strategies. Due to the time-lagging of the earth’s climate system, climate risk is long term and systematical. However, climate risk assessment and management till now represents a new research area having a number of essential features, which require further consideration and exploration. Apparently, the integration of risk assessment and management techniques with economic and weather and climate models is one of the most appropriate and beneficial strategies for the development of climate risk management systems, which actually are decision support tools for societal, industry planning and adaptation (e.g. [4-6]). The risk modeling system discussed in this paper serves as a framework and methodology to quantify risks caused by climate change and to support the development of adaptation measures as well as hedging strategies. This system is a continuously upgraded intellectual instrument that allows for users to facilitate the assessment and management of climate change impacts on human activities including activities in coastal zones. The system integrates knowledge-based subsystem, outputs of various recognized climate models, downscaling techniques, weather generators and also multi-sectoral economic models.

II. Risks of climate change and its quantification

Risk is an inherent part of almost any human activity. Depending on the context, there are lots of definitions of risk in use. The ISO 31000: 2009, a family of standards relating to risk management codified by the International Organization for Standardization, defines the risk as the “effect of uncertainty on objectives” [7]. Here uncertainties include events, which may or may not occur, and uncertainties caused by vagueness or a lack of information. This definition includes both negative and positive impacts on objectives. In business practice, risk is understood as the amount of loss that can be expected to occur due to some event during a given time interval. Climate risk, which results from changes occurring in the earth’s climate system, represents a new risk facing our civilization today. The effects of climate change are already being felt around the world. It is expected that these effects will be more severe in the future. Climate related risks are generated by a wide range of natural hazardous events that can happen suddenly. However, some of these events can evolve slowly. Usually climate risk is associated with strong events the occurrence frequency of which is low. According to last several reports of Munich Re, a German reinsurance group which is leading company in the world, the number of natural catastrophic events, including weather-related events, has a positive trend over the last few decades. For example, since 1980 the number of severe floods has almost tripled, and storms have nearly doubled, which Munich Re’s insurance experts link, at least in part, to the impact of climate change. Analysis provided by the world’s second-largest reinsurer, Swiss Re, is completely consistent with Munich Re data.

Climate alteration directly affects social and natural systems. Risks arisen from impacts of the physical climate system represent direct climate risks. This relates to extreme values of the climate and weather variables and extreme natural events. Thus, direct risks of climate change are related to industries and human activities that strongly depend on the environmental conditions. However, climate change is also a source of indirect risks such, for example, as legal and regulatory risks, litigation and reputation risks, competitive and production risks. These risks do not arise directly from changes to climate system and related climate or weather variables, but from the range of consequences produced by climate change (Fig. 1). These consequences may affect the organization’s capacity to achieve its goals and objectives.

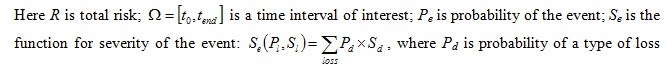

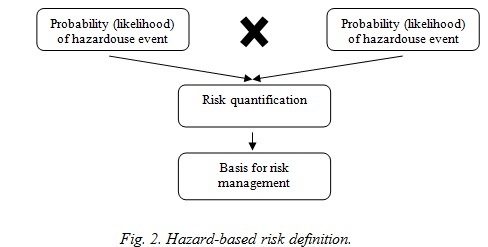

The risks to society and ecosystems from increases in GHGs and climate change necessitate the development of effective approaches to identifying and understanding these risks. Diverse climate and weather information is required as an input into climate risk assessment process. Since climate remains today an extremely complex area of scientific study, the main method for exploring climate is mathematical modeling. Consequently, climate change projection data used in climate risk assessment process represent an output from climate models driven by various scenarios of GHG and aerosol emissions. In order to quantify risk, various techniques are available today for the use in different industries and businesses [8]. Two major approaches that can be helpful to estimate risks associated with climate change are a natural hazard-based approach and a vulnerability-based approach. The Glossary of the IPCC Fifth Assessment Report defines hazard as follows [9]: “The potential occurrence of a natural-induced physical event or trend, or physical impact, that may cause loss of life, injury, or other health impacts, as well as damage and loss to property, infrastructure, livelihoods, service provision, and environmental resources. In this context, the term hazard usually refers to climate-related physical events or trends or their physical impacts”. Mathematically the scale of risk associated with hazardous events over certain period of time can be determined in statistical sense as the product of an event occurring multiplied by the severity associated with that event (Fig. 2):

(damage) for the event; and Sd is severity of a type of loss (damage) for the event. Climate-related risks, however, can be associated not only with natural hazards but also with small-amplitude slow-changing fluctuations of climate variables and their trends, which are the result of climate change. In this case risk can be defined as the likelihood of exceeding critical thresholds of some criteria obtained by vulnerability analysis (vulnerability-based approach).

The severity of the impacts of hazardous and non-hazardous climate events depends on two main factors: the level of vulnerability and exposure of these events. The Glossary [9] defines vulnerability as follows: "The propensity or predisposition to be adversely affected. Vulnerability encompasses a variety of concepts including sensitivity or susceptibility to harm and lack capacity to cope and adapt”. In climate change publications, vulnerability is considered as a function of the character, magnitude, and rate of climate variation and change to which a system is exposed, together with its sensitivity and adaptive capacity. Exposure is another factor of risk that is defined as “The presence of people, livelihoods, species or ecosystems, environmental services and resources, infrastructure, or economic, social, or cultural assets in place that could be adversely affected” [9]. Both vulnerability and exposure must be determined for assessing and managing risks since risk actually is a function of hazard, exposure and vulnerability [8].

Since risk in its most general form is considered as random variable, in complicated cases it is required the development of realistic risk assessment models based on advanced mathematics and computer modeling. Such models allow for predicting the behavior of complex systems operated in changing environmental conditions in the presence of uncertainty. In this context one of the most complicated and important models are those, which attempt to quantify effects of climate change. Acquiring knowledge about climate risks is the first step toward managing it and, consequently, reducing it. This knowledge is acquired by means of climate risk analysis.

III. Essentials of risk assessment and management

Climate risk management is defined as follows [9]: “The plans, actions or policies to reduce the likelihood and/or consequences of risks or to respond to consequences”. A number of standards developed by the International Organization for Standardization (ISO) provide the general framework for climate risk assessment and management. Standard ISO 31000:2009, Risk management – Principles and guidelines [7], provides main principles, framework and a process for managing risk. This standard can help any organization regardless of its size, activity or sector increase the likelihood of achieving objectives, improve the identification of opportunities and threats and effectively allocate and use resources for risk treatment. Standard ISO/IEC 31010:2009, Risk management – Risk assessment techniques focuses on risk assessment, which helps decision makers understand the risks that could affect the achievement of objectives. This standard concentrates on risk assessment concepts, processes and the selection of risk assessment techniques. The next document, ISO Guide 73:2009, Risk management - Vocabulary complements ISO 31000 by providing a collection of terms and definitions relating to the management of risk.

Generally, risk assessment is the process of analyzing potential losses from a given hazard using a combination of known information about the situation, knowledge about the underlying process, and judgment about the information that is not known or well understood. Since risk is defined as the product of a hazard and the probability that this hazard occurs (see above), these two values must be known (estimated) in order to define risk. Risk assessment consists of four general steps [8]: (a) hazard identification; (b) exposure assessment; (c) effect assessment; and (d) risk characterization (description of the nature of adverse effects, their likelihood, and the strength of the evidence behind these characterizations). Estimating risk is based on modeling, analyzing historical data, breaking down the system into known subsystems using techniques such as event trees or fault trees, analogy with similar situations, comparison with similar activities, or by using a combination of methods. Risk assessment creates the basis for making a decision about future actions. Risk assessment is performed primarily for the purpose of providing information to those who make decisions about how that risk should be managed.

Risk management combines a risk assessment with decisions on how to address that risk. According to ISO 31000:2009, the risk management process involves: (a) setting objectives and establishing the context of the risk assessment; (b) identifying the risks; (c) analysing the risks to determine the level of risk, which is defined as the combination of the consequences and likelihood of the risk; (d) evaluating the risk, to decide if a risk is acceptable, tolerable or unacceptable; (e) treating the risks, focusing on those risks which are intolerable; and (f) monitoring and review, to continuously refine and improve the assessment and risk treatments. The first three steps represent risk assessment process.

IV. Coastal zones and their vulnerability to climate change

Coastal zones are the interface between the continents and oceans. These zones are very important because a majority of the world's population inhabit such zones. Coastal areas are also characterized by significant natural and ecological values. Assessing coastal vulnerability to climate change has a high priority in the risk management and in the development of adaptation strategies. Climate changes impose extra pressure on coastal zones by increasing vulnerability on already highly vulnerable areas [10]. Vulnerability is a function of the character, magnitude and rate of climate variation to which a coastal system is exposed, its sensitivity and adaptive capacity. Formally, this can be expresses as follows:

Vulnerability = function (Exposure, Sensitivity, Adaptive Capacity)

It is obvious that vulnerability is directly proportional to exposure and sensitivity, but inversely proportional to adaptive capacity. Hence reducing vulnerability requires reducing exposure via specific measures, or increasing adaptive capacity via activities that are focused on the realization of sustainable development priorities. Vulnerability assessment has much in common with risk assessment and, generally, includes the following steps: (a) registering assets and resources in a coastal system; (b) ranking these resources; (c) identifying potential threats to each resource; and (d) mitigating the most severe vulnerabilities for the most valuable resources. Climate change vulnerability assessment aims at assisting decision-makers in adequately responding to climate change by investigating how projected climate changes affect human activities and natural systems. The assessment depends on the system under consideration. Each assessment is undertaken at the relevant spatial and temporal scales, and the results are appropriate only at those scales.

Coastlines undergo permanent changing via the action of various factors such as wave power and direction, wind velocity, tides, rates of relative sea level change, sediment supply, removal and transport, the intensity and frequency of extreme natural events, etc. Climate change affects all of these drivers and consequently induces additional vulnerability to coastal zones [1]. So, climate change strongly threatens coastlines. Sea level rise represents the most important source of risk for coastal areas caused by climate change. Additional risks for coastal zones are flooding, erosion, changes in sea-surface temperature, altered precipitation, changes in ocean chemistry and ice-cover, loss of ecosystems, freshwater shortage, the intensity, frequency and duration of extreme weather events. Table 1 shows main climate change drives that directly and indirectly affect coastal zones.

Table 1. Main climate change drivers and possible direct and indirect impacts on coastal zones [11]

|

Climate change driver |

Main direct physical effect |

Potential secondary and indirect impacts |

|

Changes in sea level and sea-surface temperature |

Increased coastal erosion Increased inundation of coastal wetlands and lowlands Increased risk of flooding and storm damage Increased salinization of surface and ground water; Poleward migration of species Increased algal blooms |

Infrastructure and economic activity impacted Displacement of vulnerable populations |

|

Altered precipitations |

Altered lowland flood risk Water quality impacts Altered river sediment supply |

Implications for erosion and flooding |

|

Altered wave characteristics Changes in storm frequency and intensity Melting ice |

Altered wave run-up, erosion and accretion Increased waves and surges Rapid uplift of the coast |

Further erosion Further storm damage |

|

Increased concentration of GHG in the atmosphere and ocean |

Increased ocean acidification Increases disruption to food chains |

Impaired movement and function of high oxygen demand fauna |

Various geographical regions are exposed differently to climate change [1, 4, 10]. For example, along the Baltic coastline, the vulnerability to flooding and erosion due to sea level rise is presumed to be low. Most impacts are projected for marine ecosystems, since the migration of species from the semi-enclosed sea will be difficult when the sea surface temperature rises. Other main hazards and vulnerabilities are storm surges, salt water intrusion, socio-economic vulnerabilities (i.e. fisheries). Significant sea level rise, storm surges, a large number of low-lying areas and high economic and population densities make flood-risk a main concern for the North Sea countries. Altered salinity, salt water intrusion, loss of marine habitats, ecosystems and biodiversity are also relevant to this geographical region. In the Barrens and Norwegian marine basin, the main climate risk is flooding due to sea level rise and changes in both the direction and the power of waves. The possibility of the coast rapid uplift and an increase in the frequency and magnitude of storms, including storm surges, is indeed a concern along Norway’s and Russia’s coast. It is important to emphasize that humans can increase their vulnerability by urbanisation of coastal flood plains, by deforestation of hill slopes or by constructing buildings in risk-prone areas. Vulnerability is an individual to a given geographical region, industry sector or economic entity and depends on a number of characteristics (e.g. ecological, socio-economic, technological). Since exposure, sensitivity and adaptive capacity vary in time, vulnerability is also changes in time. Vulnerability assessment requires diverse instruments at different time and space scales, in different geographical locations taking into account policy objectives. Since the implications of climate change are long-term and dynamical changes in coastal zones are extremely complex, response on climate change requires integrated vulnerability and risk assessment and management instruments that cover a wide range of scales from local to continental.

V. Generic structure of climate risk assessment and management system

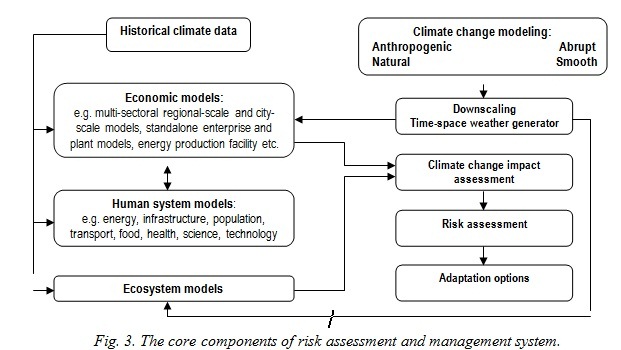

The core components of the system discussed in this paper are shown in Fig. 3. It consists of several modules of models. Aggregated economic models of various scales (e.g. multi-sectoral regional- and multi-sectoral city-scale models, economic entities (plants, enterprises, energy generation facilities models) together with human system models (such as energy, infrastructure, population, transport, food, health, sciences, technology models) and historical climate and economic data are used to assess an economic impact of climate and harmful events, and to estimate the sensitivity of economic output with respect to variations in climate variables and hazards. Retrospective climate and economic data allow one to calibrate economic models and then apply in a risk assessment process. Economic impact modeling serves also as the threshold detector giving us an acceptable risk estimates for each particular economic activity. Acceptable risk is a risk that is understood and tolerated usually because the cost or difficulty of implementing an effective countermeasure for the associated vulnerability exceeds the expectation of loss. The system includes also models of species biodiversity, water resources, forest growth, terrestrial carbon cycling and land use to assess climate change impact on ecosystems.

Climate change modeling module provides climate information that is required to model an economic impact of projected climate change using aggregated economic models. Climate data include mainly climate model output generated by climate models relevant to understanding potential future climate change. This includes raw climate model output that was processed to remove errors (bias correction). We apply data produced using internationally recognized climate research models, whose outputs passed through quality control and scientific assessments of climate change. To obtain local-scale climate information downscaling techniques both dynamical and statistical are applied to transform output of climate models into local variables. In order to make up for missing climate information and represent it in the form required by the tools of risk management, some stochastic weather generators are used in the system. Climate information is then used to assess the risks of climate change and develop adaptation options including hedging.

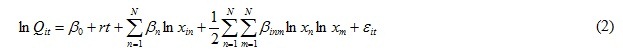

One of the most important components of the system is the economic assessment module. There is a very big uncertainty on how climate variables affect various industries and businesses. Assessing the economic impact of climate change is an extremely complex problem with a large uncertainty about both the future changes in the earth’s climate system caused by natural and anthropogenic processes and the ensuing impact on economic and social activities. Quantitative mathematical models that describe the relationship between economic output and climate variables represent one of the main and important instruments for estimating of economic impact of climate change (e.g. [12, 13]). Aggregated economic models used in the system are formulated based on the production function approach. A production function states the quantity of output Q that an enterprise, firm, city, region or country can produce as a function of the quantity of inputs to production x1, x2..........xn known also as factors of production (such as labor, capital, energy, temperature, precipitation, wind speed, the number of heating degree and cooling degree days, etc.): Q=f(x1,x2.......xn)

In our study, the empirical transcendental logarithmic (translog) production function is used:

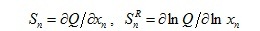

where r is the real discount rate, i is an indicator of economic sector (economic entity), t is time, β0, β1,…, βn are unknown coefficients, and εit is the error. Using historical economic and climate information, we can estimate the coefficients of the model (2). A business impact analysis is also used to determine the potential impacts resulting from the interruption of business processes that are sensitive to climate variables. By differentiating the model output Q (or ) with respect to some input factor  (or ), we obtain an absolute and relative sensitivity functions:

(or ), we obtain an absolute and relative sensitivity functions:

Function shows changes in the output Q due to variations in the input factor  . The relative sensitivity function is used to compare input factors to find out what factor is the most important for a certain percent change in the input factor. If is a small variation in the input parameter

. The relative sensitivity function is used to compare input factors to find out what factor is the most important for a certain percent change in the input factor. If is a small variation in the input parameter  caused by climate change, then the change in output Q induced by is estimated as . Sensitivity is then used to assess the vulnerability of climate change. When combined with likelihood of occurrence, climate vulnerability using the equation (1) can be redefined in terms of climate risk. The results of an assessment represent quantitative descriptions of modelled changes in systems under consideration caused by climate alterations for a given GHG emission scenarios.

caused by climate change, then the change in output Q induced by is estimated as . Sensitivity is then used to assess the vulnerability of climate change. When combined with likelihood of occurrence, climate vulnerability using the equation (1) can be redefined in terms of climate risk. The results of an assessment represent quantitative descriptions of modelled changes in systems under consideration caused by climate alterations for a given GHG emission scenarios.

VI. Climate derivative as a source of capital investment for adaptation

There is no doubt that a large amount of capital investment is required to implement climate change adaptation plans. As a rule, the source of these investments is central (federal) governments or international financial institutions (e.g. World Bank, International Finance Corporation, International Monetary Fund). At the same time the global derivative market may be considered as a huge potential source of capital investment for the realization various adaptation programs around the globe. The size of the over-the-counter (OTC) derivative market, according to “the Economist”, accounted about $700 trillion, and the size of the market traded on exchanges totaled additional more than $80 trillion. Since any derivative is a financial product, the value of which depends on several key parameters, one of the most important issues is the determination of price of derivative. Climate modeling and downscaling together with the stochastic financial simulations provide the foundation for estimating prices of special derivative instruments known as climate and weather derivatives, which can serve as a source of investments for the implementation of climate adaptation programs.

A derivative is simply a contract or security whose payoffs depend on the price of some underlying index or asset. In climate derivatives the underlying index is represented by climate-related indexes namely temperature, wind, precipitation, etc. Currently derivative contracts are let on a monthly or seasonal basis and will be let over a number of years. Climate derivatives, as one of the most powerful instruments to control climate risk, allow hedging against changes in the mean and/or standard deviation of the climate. This financial instrument can be very important for companies, organizations and businesses that have long-term exposure to the climate. Climate derivatives can be structured as put or call options, swaps or collars [14-16].

A critical issue faced by buyers and sellers of climate derivatives is the determination of a suitable pricing model. The most important input into such a model is an accurate knowledge on the future behavior of the underlying climate index, its expected value and volatility. In our system, to produce synthetic time series of climate variables used in determining underlying indices, stochastic weather generator (WG) is applied. Climate data, climate change scenarios, information on climate change and variability from GCMs, and weather data for various geographical regions serve as an input into WG. All of these data must pass through the quality control. Several thousands of realizations for each climate scenario are required to calculate reliable estimates of underlying indices that take into account future climate conditions. Then from the expected probability distribution of the climate index (or indices) the pricing of climate derivative can be easily derived.

VII. Acknowledgment

This research has been supported by the Ministry of Education and Science of the Russian Federation under project no. RFMEFI61014X0006

|

|

1. IPCC 2013: Climate Change 2013: The Physical Basis. Contribution of Working Group I to the Fifth Assessment Report of the IPCC. Cambridge: Cambridge University Press, 2014, 1535 pp.

2. Coastal Communities and Climate Change. Lloyd’s, London, 2008, 28 p.

3. The Economics of Climate Change Adaptation in EU Coastal Areas. Summary Report. Luxemburg: Office for Official Publications of the EU, 2010, 18 pp.

4. M.L. Weitzman, “On modeling and interpreting the economics of catastrophic climate change”, Review of Economics and Statistics, vol. 91, pp. 1-19, 2009.

5. H.J. Schellnhuber, W. Cramer, N. Nakicenovic, T. Wigley, G. Yohe. Avoiding dangerous climate change. Cambridge: Cambridge University Press, 2006.

6. R.S.J. Tol, “Correction and update: The economic effects of climate change”, Journal of Economic Perspectives, vol. 28, pp. 221-226, 2014.

7. ISO 31000: 2009 Risk Management - Principles and Guidelines. International Organization for Standardization, Geneva, 2009.

8. M. Rausand. Risk assessment: theory, methods, and applications. Wiley, 2011.

9. IPCC, 2014: Annex II: Glossary. K.J. Mach, S. Planton, C. von Stechow (eds.). In: Climate Change 2014: Synthesis Report. Contribution of Working Groups I, II and III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. IPCC, Geneva, Switzerland, pp. 117-130.

10. R.J. Nicholls, R.J.T. Klein, Climate change and coastal management on Europe’s coast. In: Managing European Coasts: Past, Present and Future. J. Vermaat, L. Bouwer, K. Turner, W. Salomon, Eds. Berlin: Springer-Verlag, 2005.

11. The economics of climate change adaptation in EU coastal areas. Summary Report. Luxembourg: Office for Official Publications of the European Communities, 2009.

12. J.K. Lazo, M. Lawson, P.H. Larsen, D.M. Waldman. “United States economic sensitivity to weather variability”, Bulletin of the American Meteorological Society, vol. 92, pp. 709-720, 2011.

13. J.S.L. McCombie, J. Felipe, The aggregate production function and the measurement of technical change. Northampton: Edward Elgar Publ., 2013.

14. R. Dischel. Climate risk and the weather market: financial risk management with weather hedges. London: Risk Books, 2002.

15. A.K. Alexandridis, A.D. Zapranis, Weather derivatives: modeling and pricing weather-related risk. New York: Springer-Verlag, 2013.

16. L. Susskind, D. Rumore, C. Hulet, P. Field. Managing climate risks in coastal communities: strategies for engagement, readiness and adaptation. London: Anthem Press, 2015.